Protecting Borrowers: Legal Aid in Title Loan Predation

Title loan legal assistance is vital to protect borrowers from predatory lending practices. By revie…….

In an era where financial transactions are increasingly digital, the concept of title loan legal assistance has emerged as a critical component in ensuring security and fairness within the lending industry. This comprehensive guide aims to delve into the intricacies of title loans and the legal support that underpins them, offering readers a detailed understanding of this specialized field. We will explore its global impact, economic implications, technological innovations, regulatory frameworks, and the challenges it faces. By the end, you will grasp the significance of title loan legal assistance in facilitating secure borrowing and lending practices worldwide.

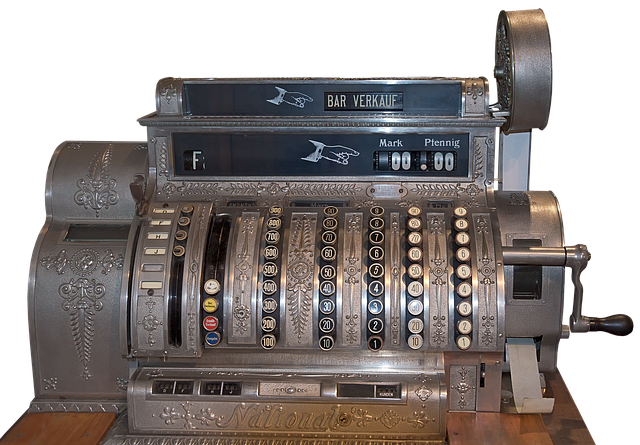

Definition: Title loan legal assistance refers to a suite of services and expertise provided by legal professionals to support and ensure the validity and security of title loans. A title loan is a type of secured loan where the borrower uses their vehicle’s (car, truck, etc.) title as collateral. The lender holds the title until the loan is repaid, ensuring repayment and providing a safety net for potential defaults.

Core Components:

Legal Consultation: Attorneys specializing in this field offer guidance on loan agreements, interest rates, repayment terms, and borrower rights. They ensure that loans comply with local and state regulations.

Document Preparation: This involves drafting and reviewing legal documents such as title transfer papers, loan contracts, and release forms to protect both the lender and borrower.

Title Examination: Legal professionals conduct thorough examinations of the vehicle’s title history to verify its authenticity, identify any liens or encumbrances, and ensure clear title ownership.

Default Management: In case of default, legal assistance includes sending demand letters, negotiating with borrowers, and guiding the foreclosure process while adhering to legal boundaries.

Historical Context: The concept of title loans has its roots in traditional secured lending practices, where collateral was used to mitigate risk. Over time, as the financial sector evolved, so did the need for specialized legal support to navigate complex regulations and protect all parties involved. Today, title loan legal assistance plays a pivotal role in facilitating quick and secure access to funds for borrowers while ensuring lenders’ interests are safeguarded.

Regional Disparities: The availability and popularity of title loans vary across the globe, with North America and parts of Europe having well-established markets. In contrast, other regions may have limited access due to regulatory differences or cultural lending preferences. For example, countries like Australia and Japan have strict regulations regarding secured loans, impacting their adoption rates.

Market Growth: The global title loan market has witnessed steady growth, driven by rising consumer debt, the need for quick cash, and changing economic landscapes. According to a 2022 report by Market Research Future (MRFR), the market value is projected to reach USD 139.5 billion by 2027, growing at a CAGR of 7.8%.

Digital Transformation: The digital revolution has significantly impacted title loan services, enabling online applications, e-signatures, and remote document verification. This trend has enhanced accessibility while raising concerns about data security and consumer protection.

Lender Perspectives: Title loans offer lenders a relatively low-risk lending option due to the collateral involved. However, high-interest rates and default risks can impact overall profitability. Lenders with diverse portfolios and robust legal support are better positioned to manage these risks effectively.

Borrower Behavior: Economic conditions heavily influence title loan demand. During economic downturns, borrowers often turn to title loans for emergency funding, while prospering economies may see a decline in usage as alternative borrowing options become more attractive.

Investment Opportunities: The title loan market presents investment prospects for financial institutions and private equity firms. Backed by substantial legal frameworks, these investments can provide steady returns, especially in regions with growing middle classes and increasing consumer debt.

Blockchain Technology: This emerging technology has the potential to revolutionize title loan processes by providing a secure, transparent, and efficient way of recording and transferring vehicle titles. Smart contracts can automate loan agreements, reducing reliance on traditional legal documentation.

AI-Powered Risk Assessment: Artificial Intelligence (AI) algorithms can analyze borrower data, including credit scores, income patterns, and vehicle information, to assess risk more accurately. This enables lenders to make informed decisions and customize loan terms accordingly.

Remote Online Notarization (RON): RON technology allows for the digital signing of documents in the presence of a notary, eliminating the need for physical meetings. This innovation streamlines title loan applications and boosts efficiency.

Consumer Protection Laws: Many countries have implemented regulations to protect borrowers from predatory lending practices. These laws dictate interest rate caps, repayment terms, and borrower disclosure requirements, ensuring fair lending standards.

Secured Lending Act: Various jurisdictions have enacted legislation governing secured loans, including title loans. These acts outline the legal framework for loan agreements, default procedures, and the rights of both parties involved.

International Cooperation: Cross-border lending activities require adherence to international laws and regulations. Organizations like the World Bank and regional financial bodies collaborate on policy matters to ensure consistent standards and protect consumers across borders.

Predatory Lending Concerns: One of the primary criticisms is the potential for predatory lending practices, especially in underserved communities. High-interest rates and aggressive marketing can trap borrowers in cycles of debt. Addressing this requires stringent regulatory oversight and consumer education.

Default Management: Efficient default management is crucial to minimizing losses for lenders and ensuring borrower retention. Legal assistance plays a vital role in negotiating reasonable repayment plans and avoiding costly foreclosure processes.

Data Privacy and Security: As title loan services embrace digital transformation, protecting sensitive borrower data becomes paramount. Compliance with data privacy regulations like GDPR (General Data Protection Regulation) is essential to maintaining consumer trust.

Strategic Solutions:

Strengthen Regulatory Oversight: Governments should enhance regulatory bodies’ capabilities to monitor title loan activities and enforce compliance with consumer protection laws.

Promote Financial Literacy: Educating borrowers about their rights, loan terms, and potential risks empowers them to make informed decisions, reducing the likelihood of predatory lending practices.

Encourage Ethical Lending Practices: Lenders should adopt ethical guidelines and responsible lending principles to foster trust and long-term borrower relationships.

Case Study 1: United States – Online Title Loan Platform Success

Company X, a leading online title loan provider, has achieved remarkable success by leveraging technology and legal expertise. They offer streamlined applications, instant approvals, and same-day funding through a secure digital platform. Their legal team ensures compliance with all state regulations, providing transparency and peace of mind to borrowers. This model has attracted millions of users, demonstrating the appeal of convenient, accessible title loans.

Key Takeaways:

Case Study 2: Australia – Regulatory Impact on Title Loans

In response to rising consumer complaints and predatory lending practices, Australia implemented stricter regulations for title loans in 2019. These reforms included interest rate caps, enhanced borrower rights, and improved disclosure requirements. As a result, the market experienced a shift towards more responsible lending, with lenders offering competitive rates and flexible terms. The case highlights the positive impact of regulatory interventions on protecting borrowers without hindering access to credit.

Lessons Learned:

Sustainable Lending Practices: The future of title loan legal assistance is likely to focus on promoting sustainable lending, ensuring borrowers can repay loans without falling into debt traps. This involves dynamic risk assessment models and personalized repayment plans.

Expanding Digital Services: Digital transformation will continue to shape the industry, with more lenders offering online applications, mobile apps, and AI-driven customer support, enhancing accessibility and convenience.

Cross-Border Collaboration: As global financial integration deepens, title loan providers will face opportunities (and challenges) in expanding across borders. Harmonizing regulatory frameworks and establishing international standards will be crucial for seamless cross-border operations.

Title loan legal assistance is a critical component in the global financial landscape, ensuring that title loans are both accessible and secure. By navigating complex legal frameworks, technological advancements, and evolving economic conditions, this specialized field supports borrowers and lenders alike. As the industry continues to adapt to digital transformation and regulatory changes, the role of legal experts will remain indispensable in fostering a fair and efficient title loan market.

Q: Are title loans a safe borrowing option?

A: Yes, when facilitated by reputable lenders and supported by title loan legal assistance, title loans can be a secure borrowing option. The collateral involved provides lenders with a safety net, and legal professionals ensure borrowers understand their rights and obligations.

Q: How do I know if a lender is reputable?

A: Researching lenders’ online reviews, checking their licensing and registration with relevant authorities, and understanding their loan terms are excellent ways to assess a lender’s reputation. Legal assistance can also provide insights into a lender’s compliance history and track record.

Q: Can I refinance an existing title loan?

A: Yes, refinancing is possible, but it depends on various factors, including the original loan amount, interest rates, and your ability to repay. A legal professional can guide you through the process, ensuring a smooth transition without incurring unnecessary fees or penalties.

Q: What happens if I default on a title loan?

A: In case of default, lenders typically initiate a formal demand process, often with the assistance of legal counsel. This may involve negotiating repayment plans or, as a last resort, foreclosure proceedings. Legal assistance can protect your rights throughout this process and help you understand the potential consequences.

Title loan legal assistance is vital to protect borrowers from predatory lending practices. By revie…….

Facing court judgments over title loans? Understand your rights by knowing local laws and seeking ti…….

Understanding state-specific regulations and seeking Title Loan Legal Assistance is vital for borrow…….

Title loan legal assistance is crucial for understanding complex terms, fees, and state regulations…….

Understanding title loan basics like secured nature, interest rates, terms, and potential consequenc…….

When seeking title loan legal assistance in Texas, understand your rights and state regulations, inc…….

When considering a title loan, understanding agreement terms and protections is vital. Title loan le…….

Title loan legal assistance is vital for navigating complex agreements and protecting rights in shor…….

Title loan legal assistance is key for fairness and transparency in the finance sector, especially f…….

Title loan legal assistance is vital for borrowers facing vehicle repossession, offering guidance on…….