Co-signers in title loans have a significant legal role, requiring active participation in debt management and understanding the process. Navigating legal aspects is crucial for co-signers to protect their financial interests, with professional Title Loan Legal Assistance offering guidance on contract interpretation, dispute resolution, and credit standing protection. These experts help borrowers avoid pitfalls, make informed choices, and achieve favorable outcomes.

Title loans can be a quick solution for financial needs, but they come with complex legal implications, especially for co-signers. This article explores the intricate world of co-signer obligations in title loans and the subsequent legal challenges. We delve into your rights and responsibilities, offering guidance on navigating these issues. Furthermore, we emphasize the importance of seeking expert legal assistance for disputes, ensuring you understand the terms and conditions to protect your interests.

- Understanding Co-Signer Obligations in Title Loans

- Navigating Legal Issues: Rights and Responsibilities

- Seeking Expert Help for Title Loan Disputes

Understanding Co-Signer Obligations in Title Loans

In a title loan, a co-signer assumes a significant legal obligation alongside the primary borrower. Their role involves ensuring timely repayment to maintain ownership rights over the secured asset, typically the borrower’s vehicle. This responsibility is crucial, as it protects the lender by providing an alternative source of repayment if the primary borrower defaults. Understanding these co-signer obligations is essential for anyone considering a title loan, as it involves not just signing paperwork but also accepting active involvement in managing the debt and potential consequences.

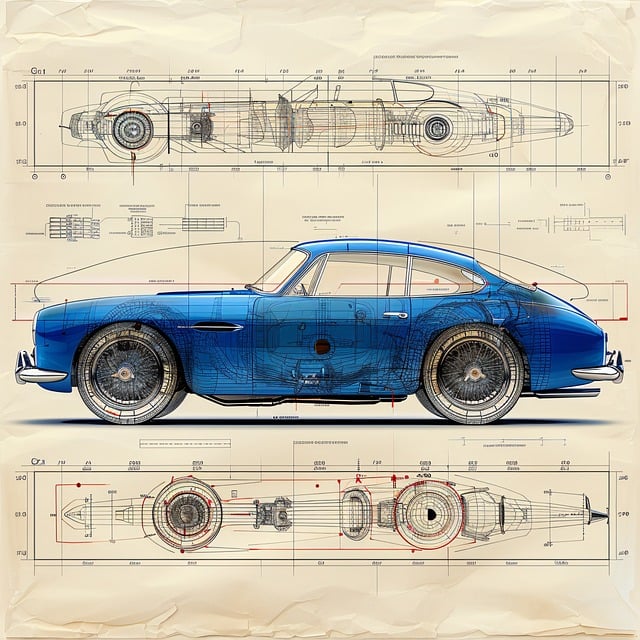

The title loan process includes a comprehensive vehicle inspection to assess its equity value. This step is pivotal in determining the loan amount available and setting clear terms for repayment. Co-signers must be aware of this phase, as it directly impacts the financial agreement they are entering into. By participating actively in the title loan process, from understanding the initial terms to being present during vehicle inspections, co-signers can better comprehend their legal commitments and take necessary steps to resolve any issues that may arise, thus securing a favorable outcome for all parties involved.

Navigating Legal Issues: Rights and Responsibilities

Navigating Legal Issues involves understanding your rights and responsibilities, especially when it comes to co-signing a loan. As a co-signer on a title loan, you’re legally bound by the terms of the agreement. This means ensuring timely payments to maintain good credit standing and avoiding any potential legal repercussions. Should issues arise, such as the primary borrower defaulting or having their rights challenged, having access to Title Loan Legal Assistance becomes crucial.

This assistance can provide guidance on dispute resolution, contract interpretation, and protection of your financial interests. It’s important to remember that while Quick Funding options like Motorcycle Title Loans can be beneficial in urgent situations, proper understanding and management of legal aspects are paramount to preventing future complications.

Seeking Expert Help for Title Loan Disputes

When faced with legal issues surrounding a title loan, seeking expert help is crucial. Navigating complex legal procedures can be daunting, especially when dealing with financial transactions like title loans. This is where professional Title Loan Legal Assistance steps in as a game-changer. These legal experts possess an in-depth understanding of state regulations and lending laws, ensuring your rights are protected throughout the process.

With their help, you can effectively manage disputes related to loan payoffs, interest rates, or even quick approval processes. Their expertise enables them to provide tailored strategies to resolve these issues swiftly. By enlisting their support, borrowers can avoid potential pitfalls, make informed decisions, and ultimately achieve a favorable outcome in their title loan-related matters.

Title loans can be complex, especially when co-signer obligations are involved. Understanding your rights and responsibilities is crucial to navigating potential legal issues. If you’re facing problems or disputes related to a title loan co-signature, seeking expert legal assistance is a vital step. Professional help ensures you’re well-informed and protected, making it easier to resolve any challenges effectively. With the right support, you can ensure fairness and avoid unnecessary complexities in these transactions. Remember, when it comes to title loan legal assistance, knowledge is power.