Title loans provide quick cash for individuals with a clear vehicle title, assessed based on vehicle value rather than credit score. They offer flexible repayment plans and are ideal for those with poor or non-existent credit. Accessing title loan legal assistance is crucial to protect rights, understand local regulations regarding interest rates, and avoid negative impacts on credit scores. Reputable lenders in Fort Worth and Houston provide transparent terms and open communication to manage repayments effectively.

Title loans can offer quick cash, but understanding the process and seeking legal guidance is crucial to avoid adverse credit impacts. This article illuminates the path to securing title loan legal assistance without damaging your credit score. We explore the basics of title loans, navigate the legal requirements, and provide strategies for protecting your rights, ensuring a safer borrowing experience. Key focus areas include deciphering regulations, leveraging legal expertise, and minimizing credit risks associated with these high-stakes transactions.

- Understanding Title Loans: Unlocking Secure Financing

- Navigating Legal Requirements for Title Loan Assistance

- Protecting Your Rights: Avoiding Credit Impacts

Understanding Title Loans: Unlocking Secure Financing

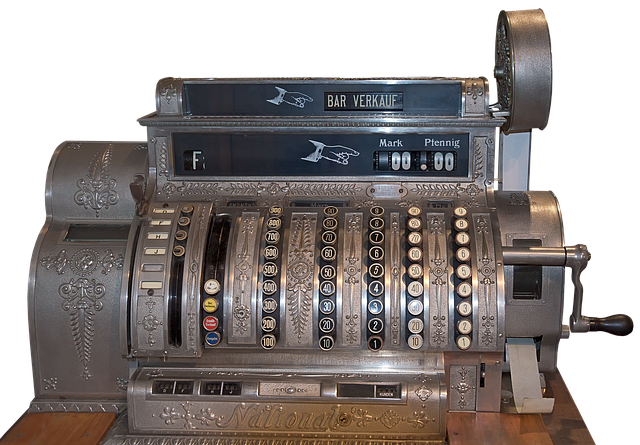

Title loans offer a unique financing option for individuals who own a clear vehicle title. This type of loan allows borrowers to use their vehicle’s equity as collateral, providing quick access to cash with relatively simpler eligibility criteria compared to traditional loans. Understanding how title loans work is crucial when seeking title loan legal assistance. Unlike typical loans that rely heavily on credit scores, lenders assess the value of the vehicle and its condition rather than the borrower’s credit history. This makes them an attractive alternative for those with less-than-perfect credit or no credit at all.

With a title loan, borrowers can benefit from flexible payment plans, making it a manageable option for short-term financial needs. The process often involves providing the vehicle’s title and driving records as collateral, ensuring a transparent and straightforward transaction. Moreover, many lenders advertise no credit check requirements, making it accessible to a broader range of individuals. This accessibility is especially valuable for those in urgent need of funds but may struggle with traditional loan applications due to their credit history.

Navigating Legal Requirements for Title Loan Assistance

Navigating the legal requirements for obtaining title loan legal assistance can seem daunting, but it’s a crucial step to ensure you’re protected and that your rights are upheld. In many jurisdictions, there are specific laws and regulations governing secured loans, like motorcycle title loans or car title loans, which serve as collateral. These rules exist to safeguard both lenders and borrowers from unfair practices and ensure transparency. When seeking assistance, it’s essential to consult professionals who specialize in these types of loans. They can guide you through the process, ensuring compliance with local laws, including those related to interest rates, repayment terms, and collection practices.

In Fort Worth Loans or any other location, understanding the legal framework is key to accessing fast cash without negatively impacting your credit score. A qualified attorney specializing in title loan legal assistance can review the terms of your loan agreement, explain your rights, and help you understand the consequences of default. This proactive approach ensures that you’re making informed decisions and can lead to better outcomes in the long run, especially when navigating a potentially complex financial situation.

Protecting Your Rights: Avoiding Credit Impacts

When seeking title loan legal assistance, understanding your rights is paramount to protecting yourself from potential credit impacts. A common misconception is that taking out a title loan will automatically damage your credit score, but with careful navigation, this doesn’t have to be the case. By law, lenders are required to disclose all terms and conditions clearly, including interest rates and repayment plans.

Many reputable Houston title loan services offer flexible payment plans tailored to suit different financial needs, ensuring you can manage repayments without causing further strain on your credit. Additionally, keeping open lines of communication with your lender about any concerns or changes in circumstances can help prevent negative marking on your credit report.

When considering a title loan, navigating the legal aspects is crucial to protect your rights and avoid negative credit impacts. By understanding both the financing process and the associated legal requirements, you can make informed decisions that suit your needs. Remember, seeking professional legal assistance for title loans ensures compliance with regulations, safeguarding your interests in this secure borrowing option.