Title loan legal assistance is vital to protect borrowers from predatory lending practices. By reviewing contracts, identifying unfair terms, and negotiating better conditions, legal experts help avoid high-interest rates and repossession. They guide individuals through debt management, ensuring state laws are followed, and offering consolidation options for San Antonio title loans or similar areas.

Title loans, despite offering quick cash, can lead to predatory lending situations with high-interest rates and hidden fees. This article explores how to navigate these risks and provides essential guidance on seeking title loan legal assistance. We delve into understanding title loans, identifying predatory practices, and employing legal strategies for loan protection. By arming yourself with knowledge, you can safeguard your financial well-being when considering a title loan.

- Understanding Title Loans and Their Risks

- Navigating Predatory Lending Practices

- Legal Strategies for Loan Protection

Understanding Title Loans and Their Risks

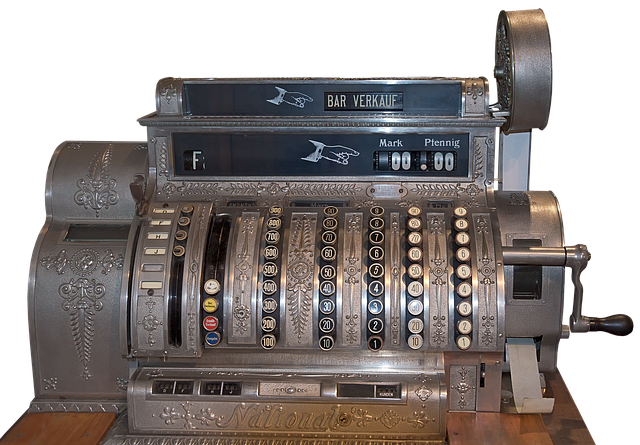

Title loans have become a popular source of quick cash for many individuals facing financial emergencies. However, it’s crucial to understand that these short-term lending arrangements come with significant risks. In simple terms, a title loan involves using your vehicle’s title as collateral in exchange for immediate funding. Lenders often provide funds based on the value of the vehicle, without conducting thorough credit checks or assessing the borrower’s ability to repay. This makes title loans particularly appealing to those with poor credit histories or who need money urgently, such as truck drivers facing unexpected repairs or individuals dealing with medical emergencies.

While these loans can offer a temporary solution, they are notorious for their high-interest rates and short repayment periods, often just a few weeks. Failure to repay on time can result in severe consequences, including repossession of the vehicle. Moreover, many lenders employ aggressive collection tactics, adding to the stress of an already challenging situation. It’s important to seek title loan legal assistance to protect yourself from predatory lending practices, ensuring you fully comprehend the terms and potential outcomes before pledging your vehicle’s title as collateral for a semi truck loan or any other high-risk financial product.

Navigating Predatory Lending Practices

Navigating predatory lending practices requires careful consideration and expert guidance, especially when it comes to title loans. These short-term, high-interest loans can trap borrowers in a cycle of debt if not managed properly. Predatory lenders often target vulnerable individuals with poor credit or limited options, offering quick cash advances without fully disclosing the steep costs and potential consequences.

Title loan legal assistance plays a crucial role in protecting borrowers’ rights. It involves evaluating the terms of the loan, ensuring fair vehicle valuation, and providing financial assistance to those who may not understand their options. Legal experts can help negotiate better terms, explain the law regarding predatory lending, and even facilitate loan repayment plans that align with borrowers’ capabilities, thus averting a potential debt crisis.

Legal Strategies for Loan Protection

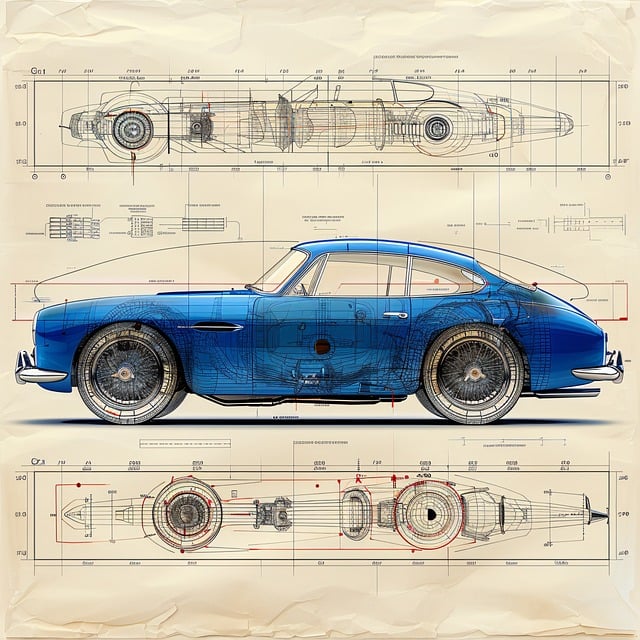

When facing a predatory lending situation with a title loan in San Antonio or other areas, having robust legal strategies is essential for protection. The first step involves understanding and reviewing the loan contract thoroughly. Many predatory lenders use complex terms and conditions that can trap borrowers into paying excessive fees and interest rates. Legal assistance can help decipher these contracts, identify unfair terms, and ensure the borrower’s rights are protected.

Additionally, a skilled attorney can advise on strategies to negotiate better terms or even challenge the validity of the loan agreement if it violates state laws. For instance, in Texas, where San Antonio is located, there are regulations in place to protect borrowers from abusive lending practices, including those related to truck title loans. Legal experts can guide individuals through debt consolidation options as well, helping them manage and repay their debts more effectively while avoiding predatory lenders’ traps.

Title loans can provide quick cash, but they often come with high-interest rates and risky terms. Understanding these risks and knowing your rights is crucial in avoiding predatory lending practices. If you find yourself in a predatory title loan situation, seeking expert title loan legal assistance is essential for protecting your financial well-being. By employing strategic legal defenses, borrowers can navigate these challenges and reclaim control over their financial future.